What are Stocks?

Stocks are securities that gives the buyer (shareholder) proportionate ownership of the company. Basis market capitalisation, stocks can be divided into large cap or bluechip stocks, midcap stocks and small cap stocks.

m.Stock offers smart web and app platforms for all your investment needs where you can place Unlimited Equity Delivery orders at ZERO brokerage.

- 20+tools

- Real-timedata

- 24*7assistance

6 reasons to start investing with m.Stock

- ₹0 brokerage on Delivery orders

- 1-click selling with DDPI

- Pledge holdings & get instant margin using Pledge Shares

- ₹0 Account Opening fee

- MTF at one of the lowest interest rates starting from 6.99% p.a. (0.0192% per day)

- Advanced tools for every investment strategy

Powerful. Stable. Secure. Trading platform

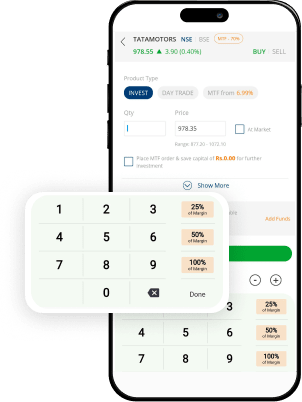

- Smart order formBuy & sell quickly with smart filters

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Advanced order typesPlace Basket & GTT orders, AMO & more

- User trading insightsView most traded scrips on m.Stock

Efficient trading: 20+ tools | Assured safety: World-class security

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

Start your investment journey

Explore stock investment opportunities

Take informed decisions using real-time market updates, fundamental & historical data

- Top Gainers

- Top Losers

- 52 Week High

- 52 Week Low

- Active by Volume

- Active by Value

Multiply your investment opportunities!

Enjoy unlimited holding period with

Unlimited trades @ ZERO brokerage

Delivery | IPO | Mutual Funds

- NOorder limit

- NOsubscription fee

- NOAMC

Unlimited trades

@ ZERO brokerage

Delivery | IPO | Mutual Funds

Passive vs Active Investing

| Differences | Passive Investing | Active Investing |

|---|---|---|

| Approach | Buying and holding stocks for long term | Buying and selling for quick gains from market trends |

| Goals | Match market performance | Beat market trends through stock selection and timing |

| Management | Minimal; requires little active decision-making | Hands-on, often requires professional fund managers |

| Risk | Lower (diversified and less prone to market timing) | Higher (depends on individual decisions and timing) |

| Cost | Lower expense ratios and fees | Higher fees due to frequent orders and management |

| Time | Requires less time and effort to manage | Requires significant research and attention |

| ROI | Steady, market-average returns over time | Potential for high returns (also prone to losses) |

Types of stock trading

Market News

View All

Ashok Leyland gains as total sales rises 2% YoY in Feb'25

However, the company's total domestic sales declined by 4% YoY to 15,879 units in the month of February.Domestic sales of medium and heavy commercial vehicles (M&HCV) fell by 7% to 10,110 units, while sales of light commercial vehicles (LCV) rose by 1% to 5,769 units in February 2025 compared to February 2024.

Ashok Leyland is engaged in the manufacture and sale of a wide range of commerc...

3 March 2025 | 9:25 AM

USFDA classifies cGMP inspection of Cipla's Virgonagar facility as VAI

Cipla has classified its current Good Manufacturing Practices (cGMP) inspection of the company's manufacturing facility in Virgonagar, Bengaluru, conducted between 7 ' 13 November 2024, as Voluntary Action Indicated (VAI).Powered by Capital Market - Live News

8 February 2025 | 11:16 AM

Indian Hotels Company schedules board meeting

Indian Hotels Company will hold a meeting of the Board of Directors of the Company on 17 January 2025.Powered by Capital Market - Live News

11 January 2025 | 9:38 AM

Cummins India gains as Q3 PAT climbs 13% YoY to Rs 514 cr; declares dividend of Rs 18/sh

Revenue from operations was at Rs 3,041.42 crore in Q3 FY25, marking a growth of 21.56% as against Rs 2,501.81 crore reported in the same quarter last year.

Profit before tax stood at Rs 670.16 crore in the third quarter of FY25, up 11.38% from Rs 601.65 crore posted in the corresponding quarter previous fiscal.

Domestic sales jumped 18% YoY to Rs 2,577 crore while exports grew by 43% ...

6 February 2025 | 12:12 PM

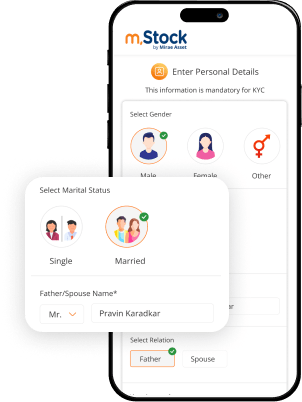

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

FAQs

What does trading on equity mean?

How do I trade in the Indian equity market?

In India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two major stock exchanges where you can trade in the equity market. You must hold a DEMAT and trading account to start Equity Trading on these stock exchanges.

Do equities differ from shares?

What does it mean when an investor short sells a stock?

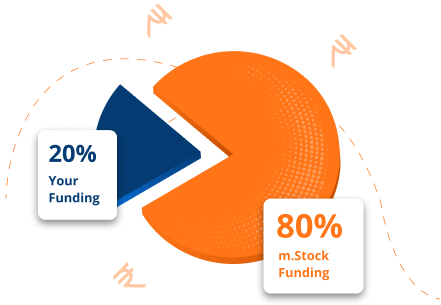

How does Margin Trading work?

Margin Trading is a type of Equity Trading where investors buy more stocks than they can afford from a broker willing to lend the stocks. The stocks will act as collateral for the broker. You open a Margin Trading Facility (MTF) account with the trader and pay a minimum margin amount that the broker can use to recover any losses. Margin trading takes place within the same day. You must square off your position at the end of every session. If not, the broker has the right to square off those shares.